After building an amazing product, you now need to let potential customers know it exists and start attracting them. To acquire customers, you start working on marketing campaigns, hoping to scale quickly. However, have you considered customer acquisition costs?

Before you ramp up your marketing budget, you need to understand the hidden costs involved and how to optimize your approach. In this article, we’ll explore low-cost alternatives to traditional, expensive marketing you can leverage to keep your customer acquisition costs under control.

What is customer acquisition cost?

Customer acquisition cost (CAC) refers to the total amount of money a company spends to gain new customers. CAC includes different expenditures, including marketing initiatives, sales efforts, and customer service-related costs.

It essentially tells a company how much it spends to turn one person who starts out unfamiliar with their brand into a customer.

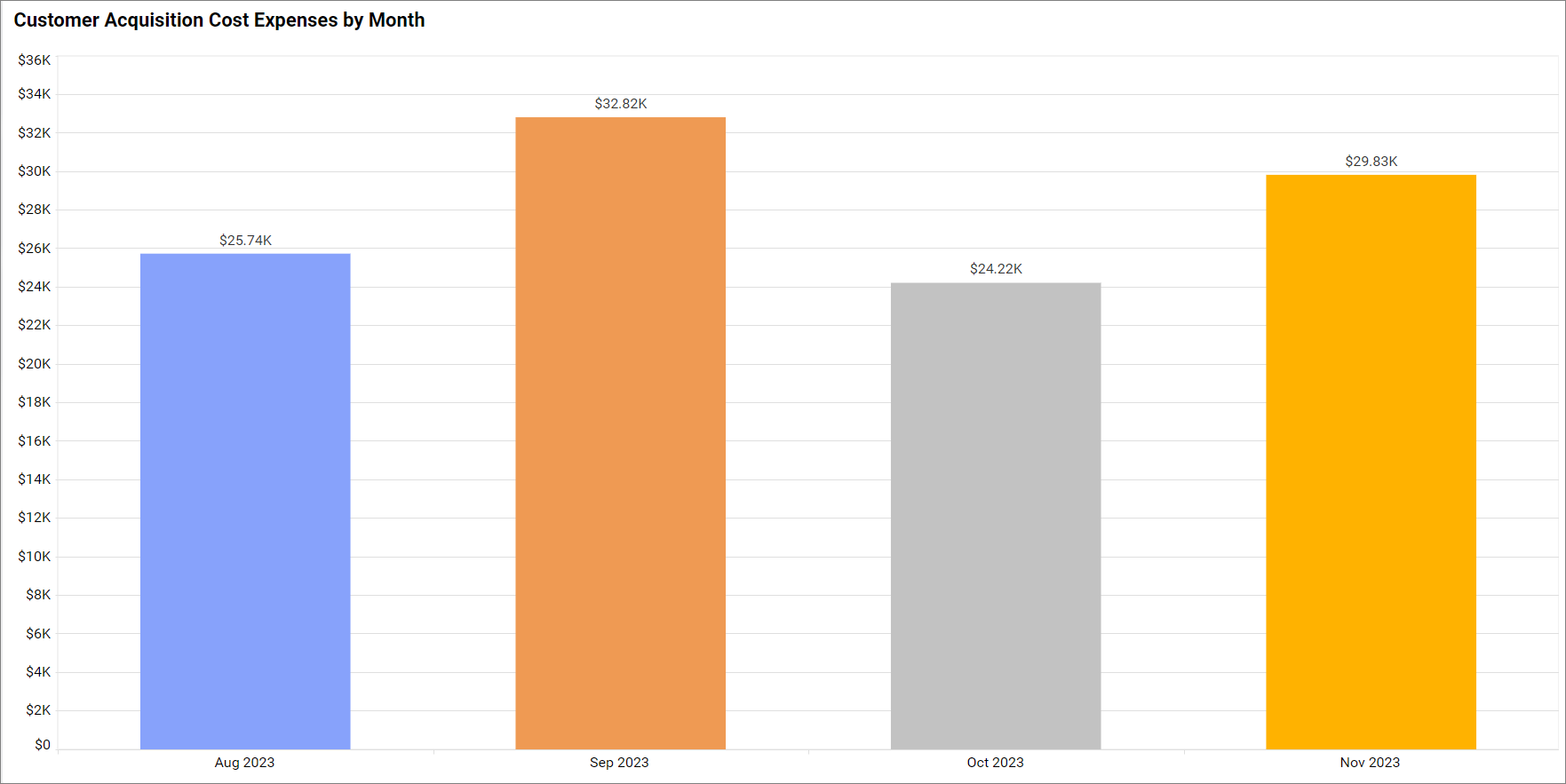

How to calculate customer acquisition cost

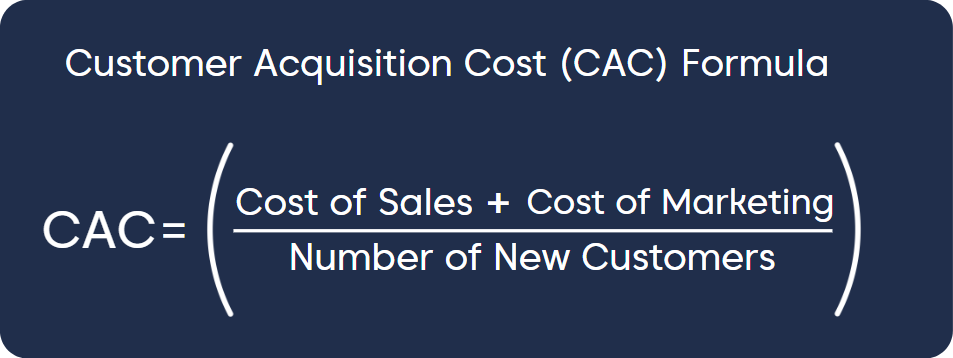

To figure out how much it costs you to gain a new customer, you’ll need to do a little math:

- Calculate your customer lifetime value: First, determine how much revenue you generate from an average customer over their lifetime.

- Track your marketing expenses: Add up how much you spend (including pay-per-click ads, social media marketing, content creation, and email) on marketing and advertising in a given time period, like a month or quarter.

- Divide marketing expenses by new customers: Determine how many new customers you gained in that time period and then divide your total marketing expenses by the number of new customers.

Total acquisition cost includes all the expenses related to acquiring new customers, like:

- Marketing costs

- Sales costs (salaries, commissions, etc.)

- Promotional offers and discounts

What is a good customer acquisition cost?

A good customer acquisition cost can vary widely based on industry, business model, and specific circumstances.

Ideally, your CAC should be significantly lower than your customer lifetime value (CLV). Aim for a CLV-to-CAC ratio of 3:1, or preferably better.

This ensures your customer acquisition efforts ultimately generate profit. Otherwise, you’ll lose money on every new customer.

An example of a good customer acquisition cost

A clothing e-commerce store spends $12,000 on Facebook ads and $3,000 on influencer partnerships. They acquire 500 new customers who make an average first-year purchase of $100 each.

CAC: ($12,000 + $3,000)/500= $30/customer

This relatively low customer acquisition cost compared to average first-year purchase suggests good customer acquisition strategy and potential profitability.

Customer acquisition cost vs customer lifetime value

Customer acquisition cost (CAC) and customer lifetime value (CLV) are two key metrics for evaluating the efficiency and sustainability of a business’s customer acquisition and retention strategies.

The following table breaks down each metric and how they relate to each other.

| Customer acquisition cost (CAC) | Customer lifetime value (CLV) |

| CAC is the average cost incurred by a business to acquire a new customer. It includes expenses related to marketing and sales efforts. | CLV is the total amount a business expects a customer to spend with them in their entire relationship with the company. |

| The CAC lets businesses understand how much they are investing to acquire each new customer. It helps in assessing the efficiency of marketing and sales strategies. | The CLV assesses the long-term value of a customer. It helps businesses understand the maximum amount they can invest in customer acquisition and retain profitably. |

| CAC = Total acquisition cost/new customers | CLV= Average purchase value × purchase frequency × customer lifespan |

Relationship between CAC and CLV

Customer acquisition cost and customer lifetime value are interrelated metrics that provide insight into the efficiency of customer acquisition.

If CAC is higher than CLV, it may indicate that the business is spending too much to acquire customers relative to the revenue those customers generate. This situation is unsustainable in the long run.

Customer acquisition costs across different industries

Customer acquisition cost can vary significantly in different industries due to variations in:

- Business models

- Target audiences

- Competitive landscapes

While it’s challenging to provide specific customer acquisition figures for each industry, we can discuss general trends and considerations:

E-commerce

CAC in e-commerce can vary based on the type of products sold, target audience, and the competitiveness of the market.

Customer acquisition cost in e-commerce can range from a few dollars to $50 or more per customer.

Software as a service (SaaS)

SaaS companies often have higher customer acquisition cost values, as acquiring customers for subscription-based services may require significant upfront investment.

CAC for SaaS companies can range from one to several hundred dollars per customer.

Finance and banking

In the finance industry, particularly for banks and financial institutions, customer acquisition costs tends to be relatively high due to the investment in reputation-building and the competitive nature of the industry.

CAC can range from $20 to hundreds per customer for complex financial services.

Healthcare

Healthcare providers and services may have varying customer acquisition cost values based on the specific services offered. CAC can range from $15 to a few hundreds of dollars per new patient acquisition.

Telecommunications

CAC in the telecommunications industry can be the cost of acquiring new subscribers for mobile plans or internet services. CAC values can range from $150 to several hundred per subscriber.

Transportation and hospitality

CAC in the travel industry depends on the type of service, such as hotels, airlines, or travel agencies. CAC can range from $20 to hundreds per customer, influenced by the competition and location.

Retail

CAC in traditional retail varies based on the type of products, customer loyalty programs, and the overall marketing strategy. Its range is usually in the low end, under a hundred per customer for stores with a larger variety of goods.

Education

In private education, CAC depends on whether it’s a traditional educational institution or an online education platform. CAC can range from $50 to several hundred dollars per student.

Real estate

Customer acquisition cost in real estate is involves marketing efforts to attract homebuyers or tenants. CAC can range from a few hundred to several thousand dollars per customer.

Technology and hardware

For businesses selling technology products or hardware, customer acquisition cost can vary based on the nature of the products. It can range from $50 to several hundred dollars per customer.

Customer acquisition cost examples

Customer Acquisition Cost (CAC) varies across industries and business models. Thus, there are several ways different companies gain new customers. Here are various examples of expenses that contribute to CAC:

Marketing costs

These are costs businesses allocate for online and offline advertisements to capture the attention of potential customers:

- Market research

- Social media ads

- Pay-per-click

- TV commercials

- Radio ads

- Print media

- Billboards

- Trade shows and networking events

- Email outreach

- SEO optimization expenses

- Other costs associated with producing marketing materials

- Analytics tools

- Customer feedback collection methods

Employee expenses

These are costs for the personnel who plan and execute the previously listed marketing activities and conduct one-on-one meetings with the potential customers drawn in by it:

- Salaries

- Employee recruitment and training expenses.

- Commissions and bonuses for the sales, PR agencies, and technical teams.

Promotional costs

These are expenses used by companies to attract prospects to make their purchases:

- Discounts

- Coupons

- Free trials

- Loyalty programs

- Premium modules

- Influencers and affiliate partnerships

Factors affecting customer acquisition costs

The following are factors that influence the customer acquisition cost for a business.

Marketing and advertising channels

How you choose to reach your target audience plays a big role in costs. Things like social media ads, influencer sponsorships, and Google Ads can get pricey fast.

Do research to determine which channels your ideal customers actually use so you’re not wasting money. And remember, a multichannel approach is usually most effective.

The target audience

Acquiring customers in highly competitive or niche markets may require different strategies and budgets. Pinpoint your target audience based on demographics, interests, behaviors, and more.

The wider the net you cast, the more you’ll end up paying. The more precisely you can target who sees your ads or content, the lower your costs will be.

Product quality and pricing

A high-quality, unique product with clear value proposition requires less convincing, attracting customers organically and lowering customer acquisition costs.

Additionally, offering competitive pricing aligned with your value proposition can make your product more attractive and reduce the need for heavy discounts or promotions, which can inflate customer acquisition cost.

Stiff business competition

The level of competition in the industry can affect CAC. In highly competitive markets, businesses may need to invest more in marketing to stand out and acquire customers.

Geographical factors

Targeting customers in different geographical regions may have different acquisition costs. Factors like shipping costs, market maturity, and cultural considerations can play a role.

Dynamic market trends

Seasonal variations in demand can influence CAC. Businesses experiencing peak seasons may need to adjust their marketing budgets and strategies accordingly.

Ways to lower your customer acquisition costs

Lowering your customer acquisition costs is key to scaling your business. Here are a few ways to gain new customers without overspending.

Set a clear customer acquisition target

Determine how much you can afford to spend to gain a new customer while still remaining profitable. Allocate your marketing budget accordingly, dropping any channels that exceed your target cost.

Regularly analyze and optimize your online sites

Continuously analyze how people are finding your business on your websites and what interested them enough to convert them into new customers.

What’s more, look for pain points in the customer journey and make changes to improve their navigation experiences.

Test different options to see what works. With regular optimization, you’ll gain new customers at a lower cost over time.

Optimize your marketing strategies

Optimizing your marketing tactics means making sure every dollar spent acquiring new customers is utilized as effectively as possible. Some tips to keep in mind:

- Focus on spending on high-value marketing channels: Spend the bulk of your budget on the marketing channels that drive the most valuable customers.

Things like social media ads, search engine marketing, and content creation tend to provide the biggest bang for your buck. Don’t waste money on outdated tactics like newspaper ads or billboards.

- Track your marketing metrics: The only way to know what’s working is to track metrics for each marketing channel, like cost per lead, cost per customer, and customer lifetime value.

Compare the numbers to see where you’re getting the best results and make adjustments as needed.

Offer promotions and discounts

Run special offers like coupons, discounts, free trials, and promotions to incentivize new customers.

People love deals and will sign up to save money. Just be sure to track the success of each campaign to determine the most effective options for the future.

Build referral programs

Tap into the power of word-of-mouth marketing. Create referral programs that reward both new and existing customers for sharing your business.

Referral customers have a high lifetime value, so the small investment will pay off.

Implementing referral programs can significantly reduce CAC. According to Stryde, referred customers have a higher customer lifetime value and are 37% more likely to convert.

Following these steps will help ensure you’re making the most of your marketing resources and gaining new customers without wasting money.

Importance of understanding customer acquisition cost

CAC is a crucial metric for businesses as it provides insights into the effectiveness and efficiency of their marketing and sales efforts. Thus, understanding CAC is crucial for businesses across various industries. Here are key reasons why understanding and managing CAC is crucial:

Enables businesses to optimize their marketing strategies

Businesses can only evaluate the effectiveness of different marketing channels and strategies if they know how many customers they should be acquiring per dollar spent.

Helps in evaluating return on investment (ROI)

The CAC provides insights into the return a business is getting from its customer acquisition efforts.

Marketing leads need to compare the CAC with the lifetime value of a customer to assess the overall profitability of acquiring customers through specific channels.

Allows informed budgeting decisions

Knowing the cost of acquiring customers allows businesses to create informed budgeting plans. This helps businesses set realistic targets and forecast future expenses based on expected customer acquisition rates, thus avoiding wastage of marketing expenditure.

Lower your customer acquisition costs to ensure business success

Understanding and optimizing customer acquisition cost is essential for business success and long-term profitability. Meeting the demands of clients in a timely and efficient manner is one of the best ways to keep the clients you manage to acquire.

Some of those satisfied clients will then recommend your business to others, which is the cheapest way to acquire even more clients.

Give BoldDesk a try if you want to improve your customer acquisition cost by creating satisfied customers through better customer service. BoldDesk offers a free trial and a 30-minute live demo so you can see how it would transform your support system.

For any clarifications or help, don’t hesitate to contact BoldDesk support.

We’d love to hear your thoughts! Share your insights, questions, ideas, or even personal experiences in the comments below. Your feedback is invaluable, and it helps us shape the future of our content to be even more helpful and engaging.

Related blogs

Email Ticketing System

Email Ticketing System